DILIGENT

Customer Due Diligence Platform | Diligent

Risk based, modular product structure ensures need based collection of data and documents

Key Product Features

Innovative, Intuitive, Drives compliant process

Requirement Generator

Single click generation of data and documents required for Clients and Connected parties across countries.

Connected Parties Identifier

Apply policy rules to auto-build visually

intutive ownership tree and capture

related party details.

Due Diligence

Perform risk based assessment on Entity,

Product, Business, PEP, Sanctions

and Adverse Media risks.

Documentation Management

Track adherence to verification requirements; Single Document Repository for Client and Connected parties.

Risk Assessment Engine

Auto risk assessment & overrides;

Workflows for checking, advice and risk based approvals.

Risk Summary & Reporting

Customer level risk dashboards; Version controlled KYC profile; Governance and Operational effectiveness reports.

Re-configure on the GO! No more expensive, time consuming system change requests or manual workarounds!

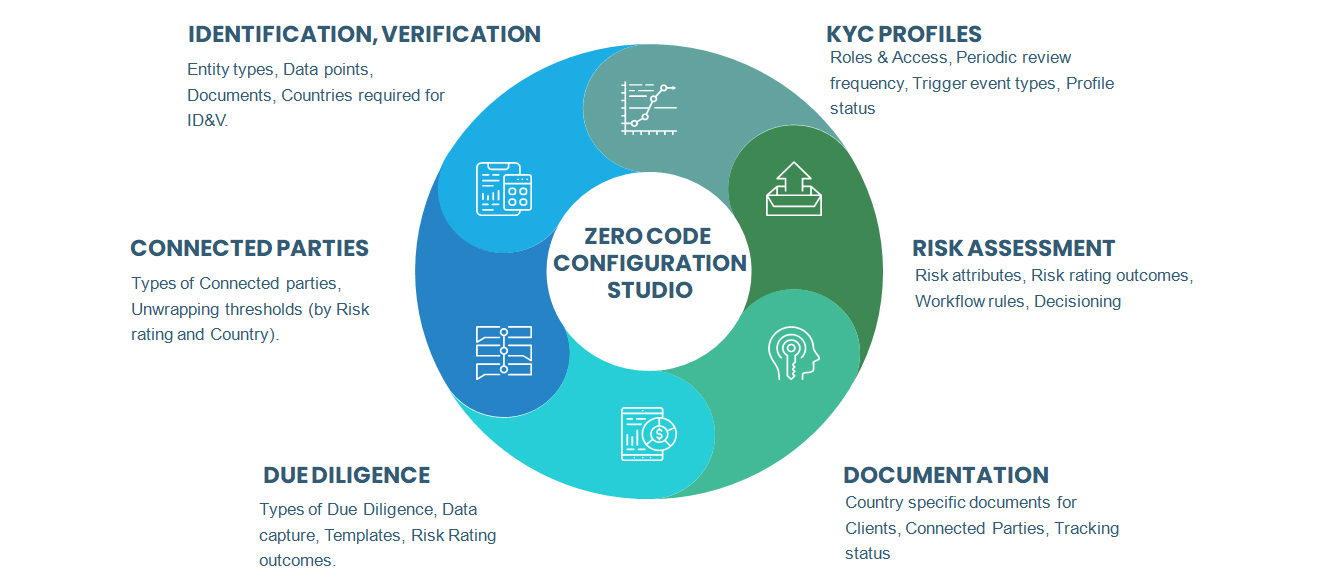

Configuration Studio

ID&V Monitor

Instant generation of ID&V requirements for any Client type & Connected parties

A 100% configurable rule engine that enables generation of Identification (ID), Verification (V) & Due Diligence requirements for ANY Client in ANY Country across ANY jurisdictions

Key Product Features

Innovative, Intuitive, Drives compliant process

Requirement Generator

Single click generation of data and documents required for Clients and Connected

parties across countries.

Configuration Studio

Re - configure ID&V policy changes to Entities, Countries, Data points, Documents, Verification on the GO!

API Integration

Seamless data exchange with external and internal systems to capture data and documents.

Beneficial Owner (BO) Unwrapper

Auto-build visually intuitive ownership trees to identify intermediate & ultimate beneficial owners

Automates application of BO determination rules for ANY Client type across ANY Jurisdiction for a given risk rating

Key Product Features

Innovative, Intuitive, Drives compliant process

Benificial Owner Identifier

Auto build of ownership tree; Identify intermediate and ultimate BOs; Trigger name screening.

Configuration Studio

Re - configure country specific risk based unwrapping thresholds on the GO!

API Integration

Seamless data exchange to capture data on client and connected parties and perform de - dupe check.

Ready to get started?

Request a demo or get in touch to learn more about how we can help.