DILIGENT

Customer Due Diligence Platform | Diligent

We are a team with a great blend of professionals from global & regional banks, data & screening service providers & technology experts. We have hands-on experience in leading businesses, managing non-financial risks, directly overseeing customer due diligence operations & developing technology solutions for large organizations.

With a proven track record in remediating customer KYC files across retail, commercial & corporate banking segments & directly interacting with regulators, we have a clear understanding of what it takes to meet or exceed expectations.

The varied experience of our core team, bound by a common purpose has enabled us to solve the unique process & system related challenges in managing financial crime risks.

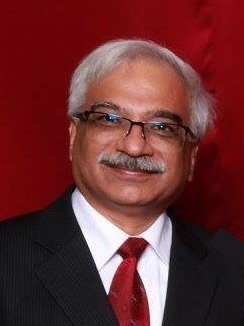

Sanjiv Bhatia

Advisor,

Singapore

Sanjiv has 25 years’ experience in CDD, AML and Operational Risk areas. He has worked in regional leadership roles at JP Morgan, Standard Chartered and Scotiabank. Sanjiv has extensive understanding of regulatory expectations and has solved regulatory challenges for these banks using innovative approaches. He has also rolled out band wide technology solutions in AML risk compliance areas. Sanjiv has also worked with IBM consulting, HCL and Pershing in business development and relationship management roles.

Sanjiv has a bachelor’s degree from IIT Kanpur and MBA from IIM Bangalore.

Email: skb@diligentkyc.com

Sandeep Khurana

Head of Markets and Products, Australia

Sandeep has held several leadership roles in the financial services industry where he has been successful at establishing the vision to create go-to-market strategies and collaborate with multiple stakeholders across Australia and APAC. Sandeep has successfully grown sustainable P&L's, led global transformations and consulted to governments and organisations from start-ups to many of the Global Fortune 500.

Sandeep was sponsored for an Executive MBA from RMIT University and also has degrees in Information Technology and Economics. Sandeep as part of the Executive Leadership team of the Tax and Accounting business at Thomson Reuters participated in a Global Leadership Program at INSEAD in Singapore and also has been sponsored for a Lean Six Sigma Master Black Belt by Ford

Sanjay Relan

Head, Enterprise Solutions, Singapore

Sanjay has over 20 years of Banking and Technology Experience. He has extensive experience in delivering and managing large enterprise solutions in banks. He pioneered implementation of innovative AML KYC solution in large banks and one of the leading experts in this area. He has been lead positions managing large initiatives in Standard Chartered, Citi and Cognizant.

Sanjay has Bachelor of Technology Degree from IIT Delhi and MBA from FMS Delhi.

Shubhada S. Bhave

Head of Business Development and Client Engagement

Shubhada has more than 15 years of strong legal and regulatory experience across India and Singapore and is recognized as a capable business partner with business acumen and ability to manage stakeholder engagement across diverse teams and geographical areas.

She has served in various capacities such as the Head-India Practice based out of Singapore for CVML, a top tier international law firm and Partner with top Indian law firm, Advani Law in India. She has also been entrepreneur having founded a Singapore based business consultancy to provide commercial and regulatory advice.

She is a Certified Anti-money Laundering Specialist and Associate Security Analyst (Cybersecurity).

She is also admitted to the Law Society of England and Wales (Non practicing) and in India (Non practicing).

She is an avid reader, and her interests include geopolitics, traveling and meeting people.

Rajesh Kalyanraman

Co-Founder & CEO,

Singapore

Rajesh has 25 years of experience holding leadership positions in Risk Management and AML areas. He has worked in HSBC, Standard Chartered and DBS Bank, apart from Financial Services consulting practice in KPMG. He has first-hand experience in implementing Financial Crime Risk mitigation systems. Moreover, as a member of Country and Global Risk Committees managing Financial Crime, he has good understanding of management priorities and challenges. Rajesh has also implemented innovative solutions in areas such as Customer authentication and Fraud prevention. He has exposure to working in different markets across South East Asia, North Asia and Middle East and managing large complex functions in Global and Regional Banks. Problem solving and Team development are his key strengths.

Rajesh has a management degree from BIM, Trichy.

Email: rk@diligentkyc.com

Our Partners

Technology and Market Access Partner, Middle East

ValueLabs

ValueLabs is a global technology company focused on Product Development, Data Technology and Digital Services. Powered by The Digital Flywheel™, they provide end-to-end solutions in the fields of Customer Experience, Data & Analytics, Product Development, and Automation. Over the last 22 years, the company has expanded to 30 locations, 5500 associates, 150 clients worldwide, and recorded an industry-leading client Net Promoter Score (NPS) of over 75.

Market Access Partner, Asia Pacific

Cambridge Combinator

Cambridge Combinator (CC) believes next generation of industrial titans will be technologists and innovators who are doing more than just challenging the status quo. CC has a global reach to partner, incubate and invest with such innovators who are tackling the problems of tomorrow and building solutions for enterprises and consumers globally. Cambridge Combinator partners with entrepreneurs building the technology of tomorrow. The startups associated with Cambridge Combintaor have one thing in common: they tackle big problem in big markets and aim to build very big companies.

Cambridge Combinator has invested in Diligent Risk Solutions Pte Ltd. Apart from funding, they play a key role in linking Diligent with an eco-system, which provides access to complimentary technology solutions, Client outreach and Infrastructure.

Market Access Partner, South Asia

TKFH Advisors

TKFH Advisors is a value enablement platform. We work with upcoming companies, helping them scale regionally.

Backed by industry veterans, TKFH Advisors brings over 60 years’ collective B2B and B2C experience. This is across capital markets, venture capital, investor relations, compliance, risk management, consumer banking and marketing. We work with a network of partners spread from Silicon Valley to the Far East helping our clients grow globally.

Market Access Partner

Foresight Solutions & Consulting Pte Ltd

Foresight Solutions is a team of senior bankers with diverse expertise in several specialised areas of banking. Leveraging rich international experience, they offer expert consulting services and best-in-class tech solutions from reputed partners.

Their areas of specialisation include Solutions & Consulting in KYC/AML/CDD, Rapid Process Automation, Data Pipeline, Big Data & Analytics related areas. Besides, they offer corporate training in these areas for the client workforce.

Foresight Solutions empower its clients to overcome multiple business challenges posed by market competition and fast-evolving regulatory & technology landscape.

Memberships & Awards

Winner 2020 IBS Intelligence Global Fintech Awards. Most effective Regtech /Compliance Deployment. Best Original and Adoptable Concept

(Year 2020-2021)

RegTech

With a clear vision to be a global centre of excellence by facilitating the building of higher performing, ethical and compliant businesses through RegTech innovation and investment, The RegTech Association was founded in 2017 as a non-profit organisation that focuses on what is needed to support the growth of the sector and to accelerate RegTech adoption.

The association brings together government, regulators, regulated entities, professional services and founder-led RegTech companies to ensure collaboration between all of the parties, promoting the RegTech industry as widely as possible, resulting in action in the uptake of RegTech proof of concepts and deployed RegTech solutions across the eco-system.

Ready to get started?

Request a demo or get in touch to learn more about how we can help.